How to Find Bank Foreclosures and Distressed Sales

by Bo Baker

How to Find Bank Foreclosures and Distressed Sales

Everyone wants a hot deal.

For those who have the ability/desire to work with a home that is, in most cases, less than perfect, foreclosures and distressed sales represent some of the hottest deals out there

If you want to locate distressed properties, the first thing you have to understand is that no one will usually advertise their home as a “distressed property” unless they are absolutely desperate to unload their home.

Homeowners, especially, don’t think in those terms and a lot of real estate agents might be hesitant to identify certain homes as such out of fear of devaluing the property - even if listing it as such is the right thing to do.

As a buyer, you’re looking for motivated sellers with properties they either no longer want or can’t handle:

- Properties with delinquent taxes

- Properties with delinquent mortgage payments

- Properties that are legally obligated to be sold due to bankruptcy or divorce settlements

- Properties being sold out of probate

- REO/bank-owned properties

- Houses that are in fair to poor shape and the seller wants them sold

As well, the majority of homes that are sold as distressed - especially foreclosures, pre-foreclosures, short sales, etc. - are going to be sold through a real estate agent. Most organizations that have access to these types of properties are not real estate brokerages and either can’t or do not want to be engaged in the job of selling homes.

This holds especially true when you take into consideration that there would be a huge conflict of interest when an organization like a bank is selling a home on which they foreclosed.

All of this said, your best bet is to find a real estate agent who has priority access to all the great deals that come up in your marketplace. This is the best place to go to get bank foreclosures and distressed sales.

If you’re adventurous, however, there are some places you can look online to locate some sweet deals and then contact your agent to have them help you secure the property at the best possible price terms and conditions.

Here’s how you would locate various types of distressed sales in your area. Remember, buying homes like these comes with a lot of pitfalls that could cost you a whole lot of money. Be sure to consult with a knowledgeable agent who can help you navigate the home purchase so you don’t make a bad investment.

Properties With Delinquent Taxes

This one is fairly straightforward: if you can find the local tax assessor’s website, you can find these types of deals. To pinpoint your search, you might need to Google for “[City Name] Tax Assessor” or “[County Name] Tax Assessor,”.

Also, remember that every tax assessor’s website is constructed differently. The vast majority of them — especially in densely populated areas — have lists of tax-delinquent properties that you can download and examine.

Properties With Delinquent Mortgage Payments

The best deals in this category are the properties that are right on the verge of foreclosure because the sellers are often the most motivated. In just about every state, you can find an official publication of these houses by Googling for “[County Name] Legal Notices,”. You can also find reliable, easy-to-understand listings at RealtyTrac.com, Foreclosure.com, and HUDForeclosed.com.

Properties Must Be Sold by Law

The sooner you familiarize yourself with your county’s legal notices, the closer you are toward locating easy-to-find distressed properties.

And, while not every county across the United States is legally obligated to post notices of bankruptcy or divorce, every county is required to announce when and where properties that are being auctioned are being auctioned.

As such, the same legal notices that cover foreclosure auctions also announce properties being auctioned for bankruptcy or divorce. Unfortunately, the data and information isn’t quite as easy to locate and browse as are foreclosure listings.

If you’re so inclined, you can build relationships with local bankruptcy and divorce attorneys so they call you when they come across a motivated seller.

Properties Sold Out of Probate

Buying probate deals are great when you can get them, but the court system doesn’t make it easy. For instance, with some courts, you can’t make an offer on a probate property without putting a 10% deposit down, and that 10% is non-refundable, whether you end up with the property or not.

The only two instances where you would get your 10% deposit back are if the court rejects your bid for legal reasons or if you are outbid. For example, should you bid on a probate sale and then find out from the home inspector that the home is falling apart, you’re still out 10% either way.

Needless to say, this makes probate houses a significant risk for any homebuyer, even if they have deep pockets. Also, it can take a long time (six months is realistic) including you being require to take many steps where in the end, you could still not wind up buying the property.

If you’re not swayed otherwise at this point, there are a number of companies that harvest probate leads and sell them. Programs like SuccessorsData.com and USProbateLeads.com are your best bets for good information on probates.

REO/Bank-Owned Properties

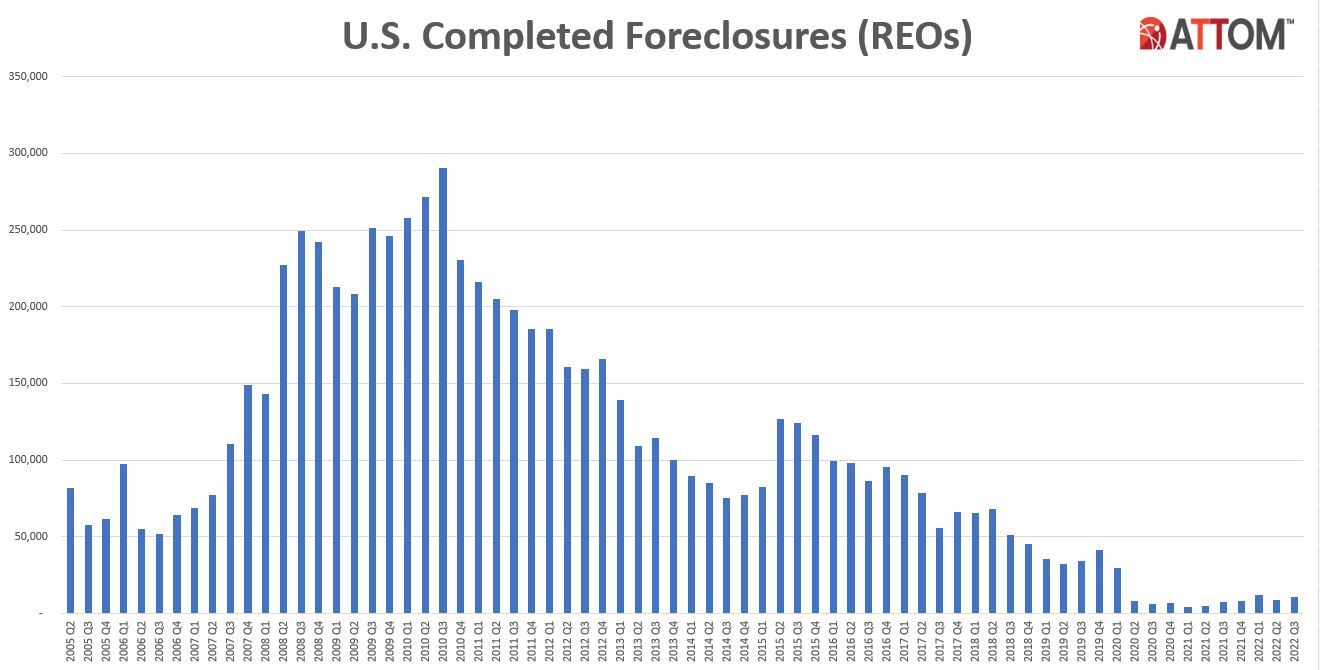

Real estate-owned, or bank-owned properties, aren’t just “distressed”; they’ve already been foreclosed upon.

Many of them sit empty, costing the companies that own them money. As a buyer of these types of homes, you need to know that 100 percent of them are sold as-is. So, if you don’t have a good reason to be confident that a particular home is solid opportunity you may want to avoid it altogether.

There are a number of sites on the Internet where you can find them, but remember, ALL REO/Bank-Owned properties are all listed by real estate agents.

If you’d like priority access to all the REO/Bank-Owned properties in the area, click here.

Finding a distressed property worth making a bid on isn’t an “if”, it’s a “when”. They are always available to buyers who are looking for them.

The important thing is to make sure that the distressed sales you’re looking at are not only worth it, but in line with what you can handle.

Go online and do your research.

Most importantly, when you do find one, get in touch with a qualified real estate agent who can guide you through the process of buying one.

Doing that will save you a lot of time, money and headaches for sure.

Click here to find a qualified agent who can help you get access to all the best bank foreclosures and distressed sales in the area.